This is your money to spend however you want. Create your guilt-free, monthly budgetĪs explained earlier, it’s called your guilt-free budget because this is what is left over after setting money aside for savings, retiremenet, and future annual expenses. Now you’re left with your total for guilt-free budget, which is how much you have left for discretionary spending. “The goal is to make sure that enough income is first saved or invested before monthly expenses or discretionary purchases are made.” This is the pay yourself first concept described in “I Will Teach You to Be Rich.” Along with budgeting for annual expenses and retirement, I highly recommend setting more money aside for extra savings. There are suggestions in the note on the budget category* cell. There is room for eight additional fixed monthly costs. If you don’t contribute to a 401k or typically receive any extra monthly income, enter $0. Follow the orange colored cells as cues for which part to fill out next. In the top left box on the Config tab, enter your income. Remember, cells with an asterisk(*) mean there is a note on that cell with more information.

Google sheets free budget template how to#

How to Use My Google Sheets Budget Template If you’re stuck and need more info to get going, read on to get the details. There are simple and clear instructions with extra notes on cells that have an asterisk(*) - just hover over those cells to the see note. If you want to try my Google Sheets budget template, make a copy of it and try it out. A good budget system will create a change in your behavior. On less of things I care little about, and more on the things I care a lot about.Ī bad budget system only shows you where your money is going. I can customize it exactly the way I need to actually help me spend my money more thoughtfully. But these apps don’t really help me spend less money - they just tell me where I spend my money and try to guess (poorly) the category.Īnd that’s why I love budgets built on spreadsheets. Most of my friends use a budgeting app like Mint and I’ve tried them, too.

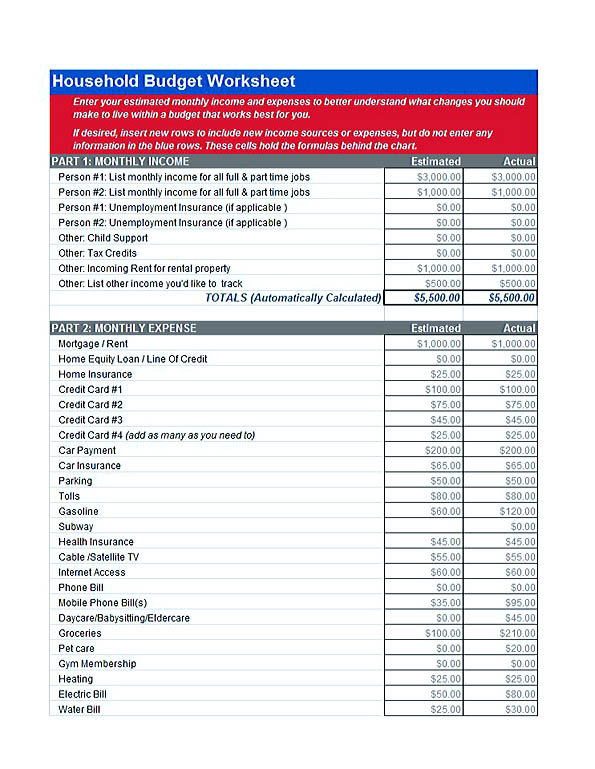

At the end of the month, you record in the "Actual" column how much you really spent during the month.įor a more detailed set of budget categories, see the Household Budget worksheet. This represents your goal - you're trying to keep from spending more than this amount. You record your desired budget for each category in the "Budget" column. The purpose of this type of budget worksheet is to compare your monthly budget with your actual income and expenses. Some numbers are included in the Home Expenses category as an example, but you'll want to replace those numbers with your own. To use this template, just fill in numbers that are highlighted with a light-blue background (the Budget and Actual columns).

0 kommentar(er)

0 kommentar(er)